So if you haven’t noticed, the Christmas period is over, there are only Bounty chocolates left in the Celebrations tin and your living room is now lacking the presence of a 7ft fake tree and a slightly iffy angel.

As always, there’s one thing that lingers around after the festive period… Christmas debt. In fact, 65% of consumers are already concerned about their 2017 debt, with debt charities are expecting a particularly busy January, and Citizens Advice gearing up for more than 370,000 people to seek advice from them.

We’re sorry to hit you with all of that doom and gloom… but here’s the upside: YourCash has donned its cape and mask and has a cunning plan to help you out.

We’ve met a few money nerds over the years (a few of those are in the YourCash marketing team) and have often probed them for advice and little financial tricks. Most of the time, their answer always boils down to one simple concept… pre-planning!

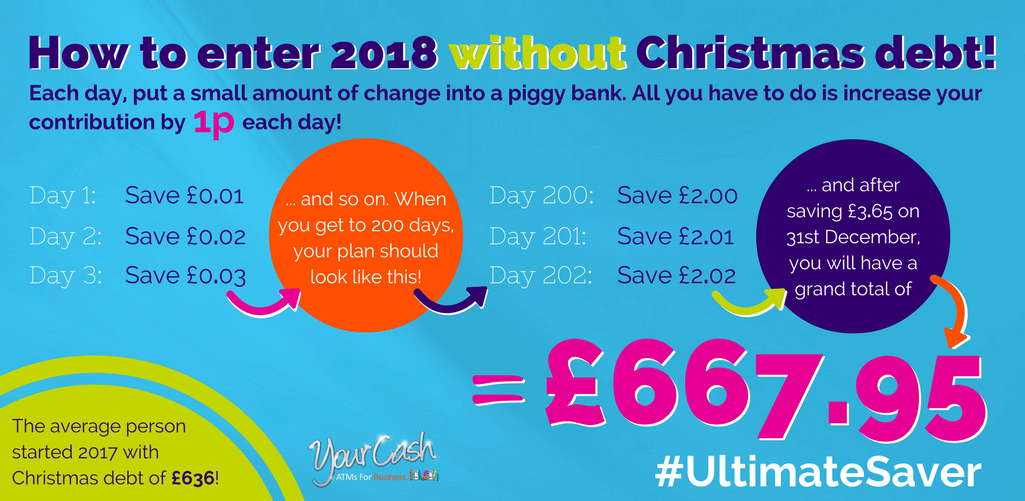

So let’s focus on the facts. The main one is that the average person will be heading into 2017 with £636 of debt – that’s a serious festive hangover!

The most sensible thing to suggest would be to make sure that this doesn’t happen next year and whilst we don’t want to promise holidays to the Caribbean or gold plated cars; we do want to keep it simple, realistic and (most importantly) achievable.

We know, we know… you’ve heard it all before. Not only that, but so many of the budgeting and saving plans expect you to contribute too much, too often… trust us though, this one’s easy.

Here’s the plan to make you an ultimate saver!

Duration: 365 days

Total saveable amount: £667.95

Method:

Day 1: Save £0.01

Day 2: Save £0.02

Day 3: Save £0.03

… We think you get the idea. Just in case you didn’t, here’s a sample of what it looks likes around halfway through the year:

Day 181: Save £1.81

Day 182: Save £1.82

Okay, we’ll stop there… but basically by the time you’ve save your £3.65 on 31st December, you’ll have £667.95 in your piggy bank.

Conveniently, that means you can cover the average debt of £636 with thirty quid extra to treat yourself (you deserve it, you’ve saved all year!). Another bonus – because you’re just starting with pennies in the first few months of the plan, you can pay off any debts leftover from Christmas 2016.

It’s amazing how simple it can be to get out of the red in early 2017 and keep in you the black for 2018.

We’ve also done a bit of maths for you. This blog was published on 12th January – the twelfth day of the savings plan – so you’ll need to start off by putting 78p into your piggy bank (our boss has already jumped on the band wagon). We hope we’ve inspired you too… so best of luck and don’t forget your 13p tomorrow!

Use the hashtag #UltimateSaver on Twitter to let us know how you’re getting on… and watch our tweets for tips and competitions!